Discretionary Portfolio Management

At our firm, we understand that every investor has different needs, goals, and risk tolerance. That’s why we offer three distinct portfolios for our clients to choose from: conservative, balanced, and aggressive.

It’s important to note that the risk of loss of capital can be present in all kind of portfolio, the risk level and potential returns are the main differentiation between these three portfolios. Additionally, it is important to note that these descriptions are a generalization and portfolio makeup will be tailored to the individual needs, goals, and risk tolerance of the investors, as well as regular portfolio review, and rebalancing.

Our goal is to help our clients find the portfolio that best aligns with their individual needs, goals, and risk tolerance, and we work closely with them to create a customized investment strategy that meets their unique objectives.

Our conservative portfolio is designed for individuals who have a low risk tolerance and prioritize capital preservation over potential high returns. It is typically made up of a higher proportion of bonds and cash equivalents, with a smaller percentage of stocks. This type of portfolio is well-suited for individuals who are nearing retirement or have a short investment horizon.

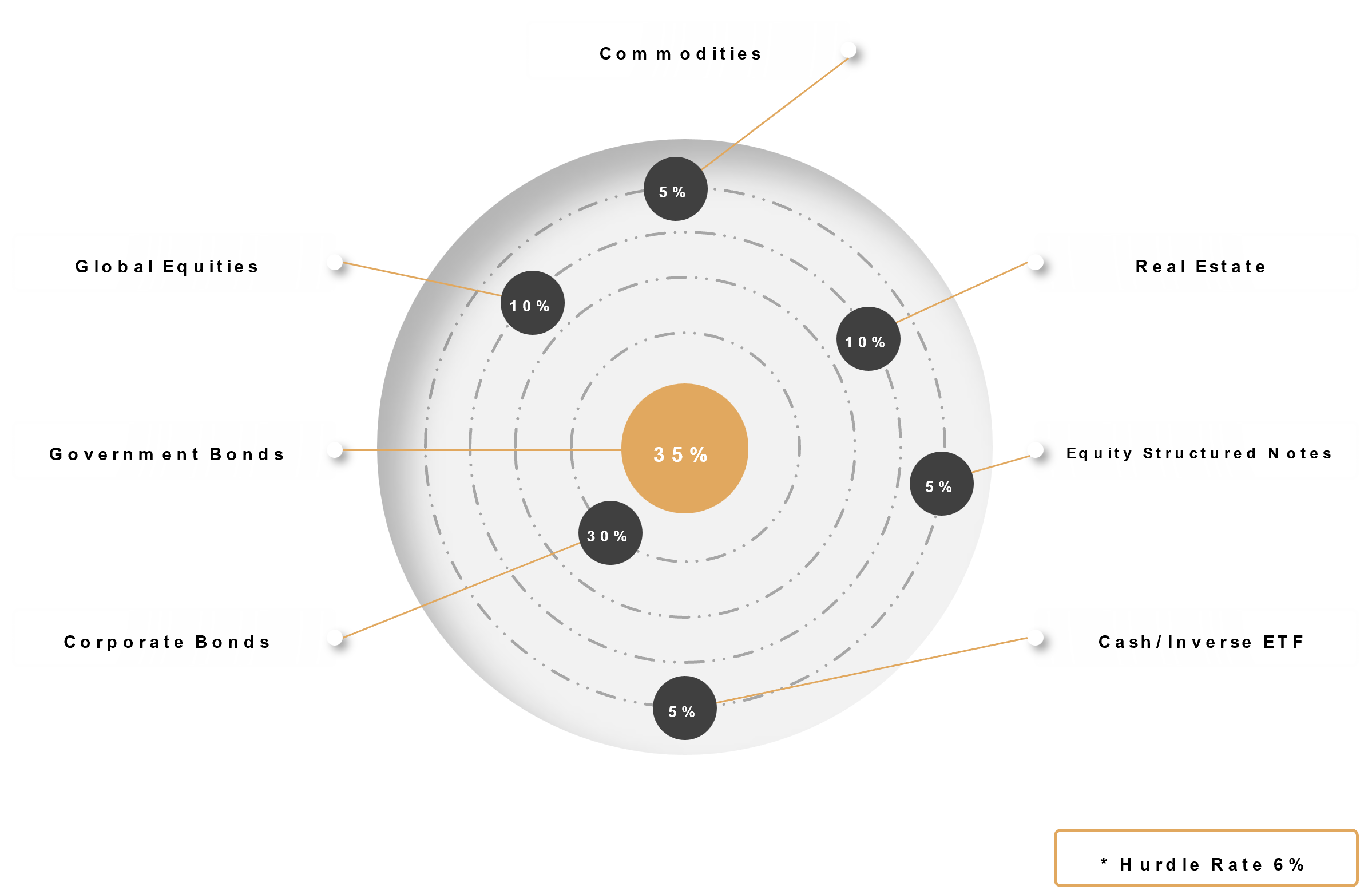

Our balanced portfolio is designed for individuals who are looking for a balance of stability and growth. It usually contains a mix of bonds, cash equivalents, and stocks. The proportion of each asset class will depend on the individual’s risk tolerance and investment goals. This type of portfolio is well-suited for individuals who have a medium-term investment horizon and are looking for moderate returns.

Our aggressive portfolio is designed for individuals who have a high-risk tolerance and are willing to accept the potential for higher returns in exchange for higher volatility. It typically contains a higher proportion of stocks and a smaller percentage of bonds and cash equivalents. This type of portfolio is well-suited for individuals who have a long-term investment horizon and are comfortable with the potential for significant market fluctuations.